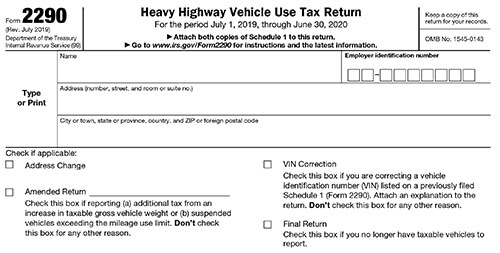

E-File Your Truck Tax 2290 Now

Simple, Safe, and secure sofware to file 2290 online

- Guaranteed Schedule 1 or your Money Back

- Quick Processing

- Stamped Schedule 1 in Minutes

- Free VIN Correction

Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

About our Truck Tax E-Filing

E-File Your Truck Tax is an IRS authorized 2290 e-file software provider. Our solution is safe, secure, and easy to use. You can create your free account and handle all of your IRS heavy vehicle use tax needs in just a few minutes! When it comes to e-filing Form 2290, all you have to do is follow our step-by-step instructions. Then you will receive a copy of your Form 2290 Schedule 1 as soon as the IRS accepts your return.

We also allow you to e-file free VIN corrections and e-file IRS Form 8849.

Features to E-File Your Truck Tax

We are a leading 2290 e-file provider. Take advantage of our innovative IRS heavy vehicle use tax e-filing features to save time and create a hassle free online filing experience.

Filing Form 2290 has never been this easy.

Get your Guaranteed Schedule 1 or Money Back

Get your Guaranteed Schedule 1 or Money Back

We guarantee that you will receive your Stamped Schedule 1 from the IRS or You will get your money back

VIN Correction for Free

VIN Correction for Free

You can freely correct your VIN, if your original Form 2290 is filed with Us.

Retransmit Rejected Returns for Free

Retransmit Rejected Returns for Free

Incase, IRS rejected your your Form 2290 you can retransmit again to IRS at

free of Cost

Instant Error Check

Instant Error Check

Before your IRS HVUT Form 2290 is transmitted directly to the IRS, the system will perform an Instant Error Check on your form to catch any basic errors. This will help reduce mistakes and you can receive your Stamped Schedule 1 without any issues.

Copy Last Year’s Return

Copy Last Year’s Return

Our HVUT Schedule 1 software is designed to save you time. You can even copy your IRS HVUT Form 2290 from last year! There’s no need to re-enter all of your information again. Get your Form 2290 Schedule 1 faster.

Auto-Generate IRS Form 8849

Auto-Generate IRS Form 8849

If our innovative HVUT Schedule 1 software finds that you have more HVUT track tax credits than the amount of HVUT you owe while filing IRS HVUT Form 2290 then we will automatically generate IRS Form 8849 for you. This way you’ll get your money back from the IRS faster.

Information Required to E-File your Truck Tax Form 2290

As the leading 2290 e-file software provider, we make handling all of your IRS heavy vehicle use tax filing needs online easy. Just provide the following HVUT truck tax information to receive your IRS Stamped Schedule 1 in no time.

- Business Information: Name, Address, Employer Identification Number,Tax Year and First Used Month.

- Vehicle Information: Vehicle Identification Number, Taxable Gross weight, etc.

When is the deadline to File your

Truck Tax 2290?

If you put a new truck on the road during a given tax year, your Form 2290 deadline is based on the vehicle's month of first use. Your deadline will be the end of the month following the month of first use. For instance, if you started using a truck in January, your Form 2290 deadline will be February 28 (unless the end of the month falls on a weekend, then your deadline will be the next business day).

However, if you are still using the same truck as the last tax year, your Form 2290 deadline will be August 31 of each year.

How to E-File your Truck Tax Form 2290 with Our Software?

Quickly complete HVUT truck tax Form 2290 and receive your IRS Stamped Schedule 1.

Enter Your Information

Enter Your Tax Period

Enter Your Vehicle Information